How to Diversify Your Business Income Streams: A Comprehensive Guide

In today's dynamic business landscape, relying on a single income stream is like navigating a ship with only one sail. When the wind changes direction, you're left adrift. This is where income diversification comes into play. By creating multiple revenue streams, you can ensure your business remains buoyant and resilient, even in the face of economic storms. So, let's dive into the world of income diversification and explore how to diversify your business income streams.

Understanding Income Diversification

Income diversification is not just about creating a safety net; it's about building a robust business ecosystem that thrives on multiple fronts. It's like planting a garden with various seeds—some may not sprout, but others will flourish, ensuring you always have a harvest.

Why Diversify Your Income Streams?

Revenue growth is the lifeblood of any business. By diversifying your income streams, you're not only mitigating risks but also opening doors to new opportunities. Imagine your business as a tree—the more branches it has, the more fruit it can bear.

Strategies to Diversify Your Business Income Streams

1. Explore Passive Income Opportunities

Passive income is the holy grail of income diversification. It's the money that keeps rolling in even when you're not actively working. Think of it as a river that flows continuously, even when you're not there to tend to it.

Invest in Real Estate

Real estate is a classic example of passive income. Whether it's commercial properties or residential rentals, real estate can provide a steady stream of income. Websites like Roofstock offer a wealth of information on real estate investing.

Create Digital Products

E-books, online courses, and digital art are just a few examples of digital products that can generate passive income. Platforms like Udemy and Amazon Kindle Direct Publishing make it easy to create and sell digital products.

2. Expand Your Product or Service Offerings

Business expansion is another effective way to diversify your income streams. It's like adding more arrows to your quiver—the more you have, the better your chances of hitting the target.

Introduce Complementary Products

If you sell coffee, why not add pastries to your menu? Complementary products can boost your sales and attract a wider customer base.

Offer Premium Services

If you provide a basic service, consider offering a premium version. For example, if you offer standard web design services, you could also offer a premium package that includes SEO optimization and ongoing maintenance.

3. Leverage Affiliate Marketing

Affiliate marketing is a powerful tool for income diversification. It's like having a team of salespeople working for you, but you only pay them when they make a sale.

Partner with Relevant Businesses

Find businesses that complement yours and offer their products or services to your customers. For example, if you run a fitness blog, you could partner with a sports equipment company.

Use Affiliate Networks

Platforms like Amazon Associates and ClickBank make it easy to find affiliate programs that suit your business.

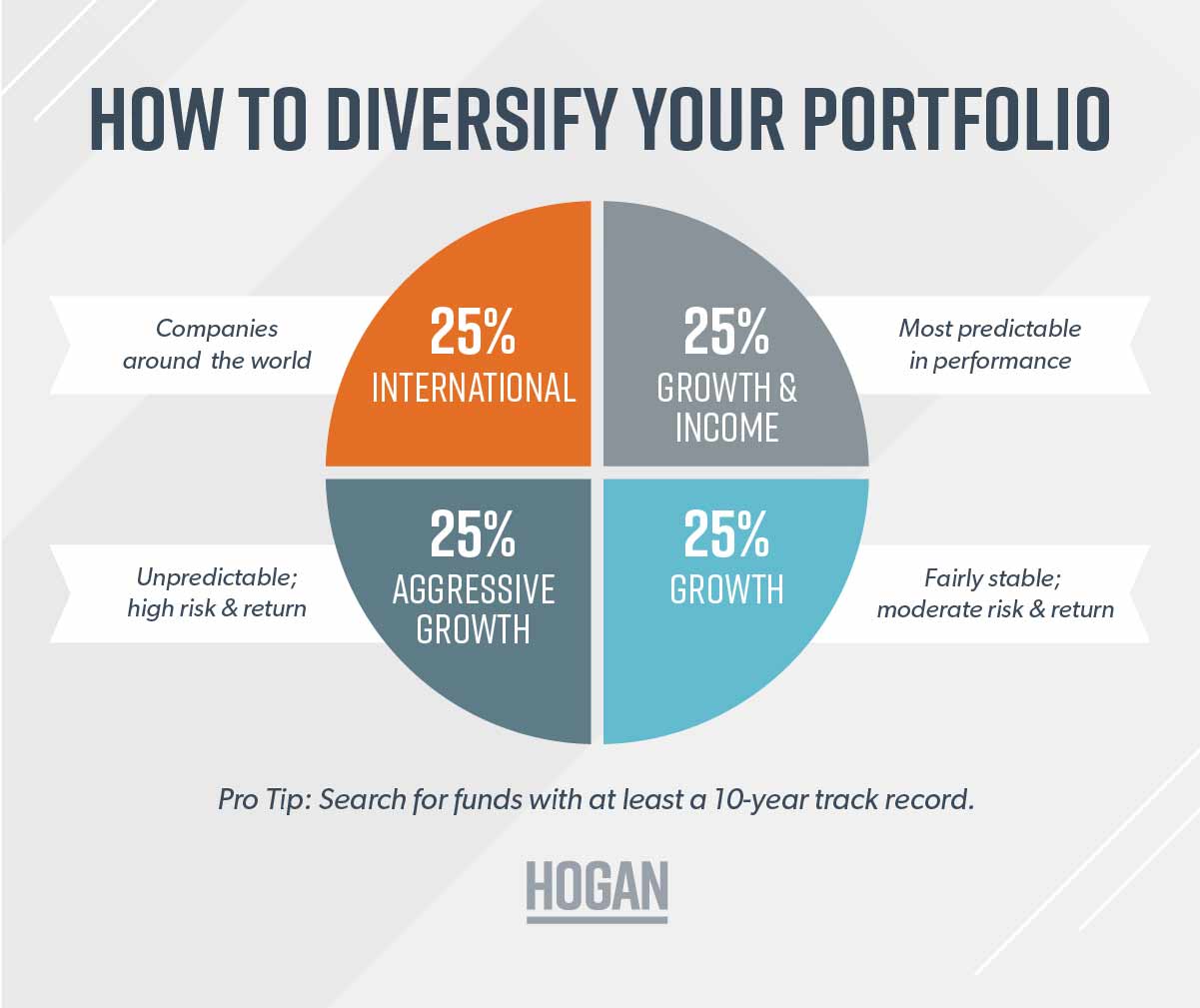

4. Invest in Stocks and Bonds

Investing in stocks and bonds is another way to diversify your income streams. It's like planting seeds that will grow into a forest of financial security.

Start with Index Funds

Index funds are a great way to start investing in the stock market. They offer a diversified portfolio of stocks, which can help mitigate risks.

Consider Dividend Stocks

Dividend stocks pay out a portion of their profits to shareholders. This can provide a steady stream of income, especially if you reinvest the dividends.

5. Monetize Your Expertise

Your knowledge and skills are valuable assets. Monetizing your expertise is like turning your brain into a goldmine.

Offer Consulting Services

If you have expertise in a particular field, consider offering consulting services. This can be a lucrative income stream, especially if you have a strong reputation in your industry.

Create a Blog or YouTube Channel

Sharing your knowledge through a blog or YouTube channel can generate income through advertising, sponsorships, and affiliate marketing.

Implementing Your Income Diversification Strategy

Step 1: Assess Your Current Income Streams

Before you can diversify your income streams, you need to understand your current financial situation. It's like taking a snapshot of your business—you need to see where you are before you can decide where to go.

Step 2: Identify Opportunities for Diversification

Look for gaps in the market that your business can fill. It's like finding a hidden treasure—you need to dig deep to find the best opportunities.

Step 3: Develop a Plan

Once you've identified opportunities for diversification, develop a plan to capitalize on them. It's like drawing a map—you need a clear path to reach your destination.

Step 4: Execute Your Plan

Put your plan into action. It's like setting sail—you need to leave the harbor to reach new shores.

Step 5: Monitor and Adjust

Regularly review your income diversification strategy and make adjustments as needed. It's like navigating a ship—you need to constantly adjust your course to stay on track.

Conclusion

Diversifying your business income streams is not just a smart business strategy; it's a necessity in today's unpredictable economic climate. By exploring passive income opportunities, expanding your product or service offerings, leveraging affiliate marketing, investing in stocks and bonds, and monetizing your expertise, you can build a resilient business that thrives in any environment.

Remember, income diversification is a journey, not a destination. It's about continuously seeking new opportunities and adapting to change. So, are you ready to set sail on the journey to income diversification? The world of opportunities awaits you.

FAQs

What is income diversification? Income diversification is the practice of creating multiple income streams to reduce financial risk and increase revenue growth.

Why is it important to diversify your income streams? Diversifying your income streams helps mitigate risks, ensures financial stability, and opens doors to new opportunities.

What are some examples of passive income? Examples of passive income include real estate investments, digital products, and dividend stocks.

How can I monetize my expertise? You can monetize your expertise by offering consulting services, creating a blog or YouTube channel, and developing online courses.

What steps should I take to implement an income diversification strategy? To implement an income diversification strategy, assess your current income streams, identify opportunities for diversification, develop a plan, execute your plan, and monitor and adjust as needed.

0 Response to "How to Diversify Your Business Income Streams: A Comprehensive Guide"

Post a Comment