How to Choose the Best Business Bank Account: A Comprehensive Guide

Opening a business bank account is akin to laying the foundation of your financial empire. It's not just about having a place to stash your cash; it's about finding a partner that understands your business needs, grows with you, and simplifies your business finance management. So, how do you choose the best business bank account? Let's dive in.

Understanding Business Banking Services

Before we delve into the nitty-gritty, let's understand what business banking services entail. Business banking is not just about deposits and withdrawals. It encompasses a suite of services, including loans, credit facilities, merchant services, and payroll management. These services are designed to streamline your business operations and foster growth.

Why Choose a Business Bank Account?

You might wonder, "Why not use my personal account for business transactions?" Well, mixing business with pleasure, or in this case, personal finances, can lead to a messy breakup come tax season. A dedicated business bank account offers numerous benefits:

- Simplified Accounting: Business transactions are separate from personal ones, making bookkeeping a breeze.

- Professionalism: Clients and partners prefer making payments to a business account rather than a personal one.

- Legal Protection: Incorporated businesses enjoy liability protection, which could be jeopardized if personal and business finances are mixed.

Comparing Bank Accounts: What to Look For

Now that you're convinced you need a business bank account, let's explore how to compare bank accounts and find the best fit for your business.

Banking Fees: The Elephant in the Room

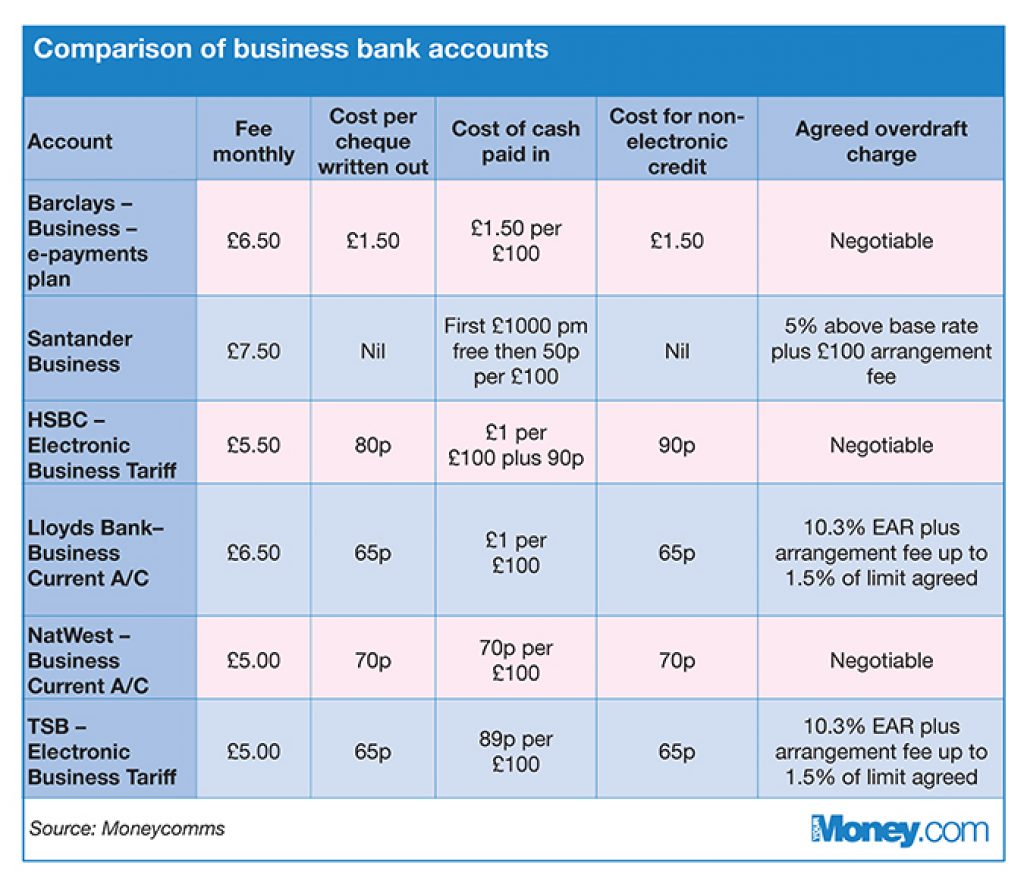

Let's address the elephant in the room first - banking fees. These can range from monthly maintenance fees to transaction fees, and they vary significantly between banks. Some banks offer fee waivers if you maintain a minimum balance. It's crucial to understand these fees and factor them into your decision.

Business Account Accessibility: Branch vs. Online

Do you prefer face-to-face interactions or the convenience of online banking? If you deal with cash often, you might need a bank with physical branches. However, if you're always on the go, online banks with user-friendly apps might be more suitable. Consider your business needs and choose accordingly.

Business Finance Management Tools

Many banks offer tools to help you manage your business finances effectively. These can include:

- Integration with Accounting Software: Some banks integrate seamlessly with popular accounting software like QuickBooks or Xero, making bookkeeping a breeze.

- Cash Flow Management: Tools that help you monitor and manage your cash flow can be invaluable for small businesses.

- Invoicing and Payment Solutions: Some banks offer invoicing tools and payment solutions, simplifying your billing process.

Scalability: A Bank That Grows with You

Your business isn't static, so why should your bank be? Look for a bank that can support your business as it grows. This could mean offering larger loans, providing merchant services, or supporting international transactions as your business expands.

Top Business Bank Account Options

Now that you know what to look for, let's explore some of the top business bank account options.

Traditional Banks

Traditional banks like Chase, Bank of America, and Wells Fargo offer a wide range of business banking services. They have numerous branches nationwide, making them a good choice if you deal with cash often. However, their fees can be higher compared to online banks.

Online Banks

Online banks like Azlo, Novo, and BlueVine offer competitive fees and user-friendly apps. They are a great choice for tech-savvy business owners who don't need physical branches. However, they may lack some of the personal touches and broader services of traditional banks.

Credit Unions

Credit unions are not-for-profit organizations that offer competitive rates and personalized service. They can be a good choice for small businesses, but they may lack the advanced features and scalability of larger banks.

Making the Final Decision

Choosing the best business bank account is like choosing a business partner. It's not a decision to be taken lightly. Here are some final tips to help you make the right choice:

- Read the Fine Print: Make sure you understand all the fees, terms, and conditions.

- Talk to Other Business Owners: Sometimes, the best insights come from peers who have been there, done that.

- Consider Your Business Needs: What works for one business might not work for yours. Consider your unique needs and choose accordingly.

Conclusion: Your Business Deserves the Best

Choosing the best business bank account is a critical step in managing your business finances effectively. It's not just about finding the lowest fees or the most convenient branch locations. It's about finding a partner that understands your business needs, supports your growth, and simplifies your financial management.

Remember, your business deserves the best. Don't settle for a bank that doesn't meet your needs or support your growth. Take the time to compare bank accounts, talk to other business owners, and make an informed decision. Your business will thank you for it.

FAQs

Can I use my personal bank account for business? While it's possible, it's not recommended. Mixing personal and business finances can lead to accounting nightmares and potential legal issues.

What documents do I need to open a business bank account? The documents required can vary, but typically, you'll need your business license, EIN (Employer Identification Number), and personal identification.

Can I open a business bank account online? Yes, many banks offer the option to open a business bank account online. However, you may still need to provide physical copies of certain documents.

What is the best business bank account for startups? The best business bank account for startups depends on your specific needs. However, online banks like Azlo and Novo are popular choices due to their low fees and user-friendly apps.

How can I avoid business bank account fees? Some banks offer fee waivers if you maintain a minimum balance. Others have no monthly fees at all. Shop around and read the fine print to understand the fee structure and how to avoid it.

External Resources:

0 Response to "How to Choose the Best Business Bank Account: A Comprehensive Guide"

Post a Comment