How to Start a Franchise Business with Low Investment

Embarking on a franchise journey can be an exhilarating adventure, much like setting sail on a new voyage. But unlike the high seas, starting a franchise doesn’t have to be a costly endeavor. In fact, there are numerous affordable franchising opportunities that can help you launch your entrepreneurial dreams without breaking the bank. Let’s dive into the world of low-cost franchises and explore how you can start your own business with minimal investment.

Understanding Low-Cost Franchises

What is a Low-Cost Franchise?

A low-cost franchise is a business model that allows you to start your own venture with a relatively small initial investment. These franchises typically have startup costs ranging from a few thousand dollars to around $50,000. They offer a lower barrier to entry, making them an attractive option for aspiring entrepreneurs who want to minimize financial risk.

Benefits of Starting a Low-Cost Franchise

Starting a low-cost franchise comes with a host of benefits. Firstly, you get to leverage an established brand, which can significantly reduce the time and effort required to build a customer base. Secondly, you receive comprehensive training and support from the franchisor, ensuring you have the tools and knowledge needed to succeed. Lastly, the lower investment required means you can start generating profits more quickly, making it a more accessible path to entrepreneurship.

Identifying Affordable Franchising Opportunities

Researching Low-Cost Franchise Options

When it comes to identifying affordable franchising opportunities, thorough research is key. Start by exploring various industries that interest you, such as food and beverage, retail, or service-based businesses. Look for franchises that have a proven track record of success and a strong support system for franchisees.

Evaluating Startup Costs

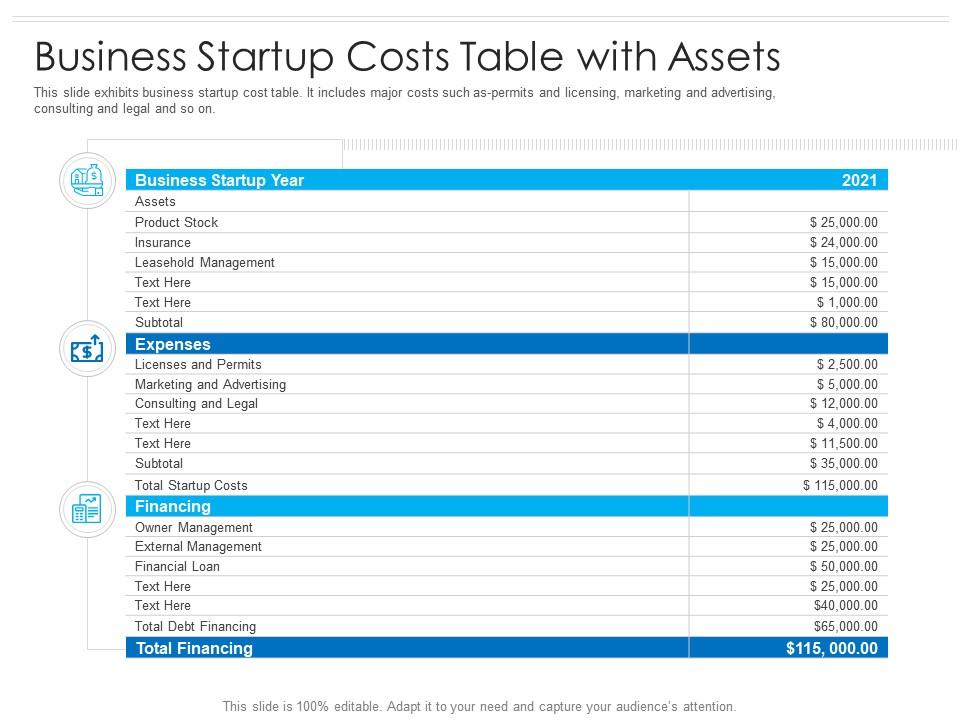

Evaluating startup costs is crucial when considering low-cost franchise opportunities. These costs can include franchise fees, initial inventory, equipment, and marketing expenses. Make sure to carefully review the Franchise Disclosure Document (FDD) provided by the franchisor, as it outlines all the financial obligations and requirements.

Steps to Start a Low-Cost Franchise

Step 1: Assess Your Financial Situation

Before diving into the world of franchising, it’s essential to assess your financial situation. Determine how much capital you have available for investment and whether you need to secure additional financing. This step will help you narrow down your options and choose a franchise that aligns with your budget.

Step 2: Choose the Right Franchise

Choosing the right franchise is a critical decision that can significantly impact your success. Consider your interests, skills, and the market demand for the franchise’s products or services. Conduct thorough due diligence by speaking with current franchisees, attending franchise expos, and consulting with industry experts.

Step 3: Develop a Business Plan

Once you’ve selected a franchise, the next step is to develop a comprehensive business plan. This plan should outline your goals, target market, marketing strategies, and financial projections. A well-crafted business plan will serve as a roadmap for your franchise journey and help you secure any necessary financing.

Step 4: Secure Financing

If you require additional financing to start your franchise, there are several options available. You can explore traditional bank loans, Small Business Administration (SBA) loans, or even seek funding from friends and family. Make sure to compare different financing options and choose the one that best suits your needs.

Step 5: Complete the Franchise Application Process

The franchise application process typically involves submitting an application, undergoing background checks, and participating in interviews with the franchisor. Be prepared to provide detailed information about your financial situation, business experience, and long-term goals.

Step 6: Attend Training and Open Your Business

After successfully completing the application process, you’ll receive comprehensive training from the franchisor. This training will cover all aspects of running the franchise, from operations and marketing to customer service and financial management. Once you’ve completed the training, you’ll be ready to open your business and start serving customers.

Investment Tips for Low-Cost Franchises

Diversify Your Investments

One of the key investment tips for low-cost franchises is to diversify your investments. Instead of putting all your eggs in one basket, consider investing in multiple low-cost franchises across different industries. This approach can help mitigate risk and increase your chances of success.

Leverage Existing Skills and Experience

Leveraging your existing skills and experience can be a valuable asset when starting a low-cost franchise. Choose a franchise that aligns with your background and expertise, as this can give you a competitive edge and help you succeed more quickly.

Focus on Customer Experience

Regardless of the industry, focusing on customer experience is crucial for the success of any franchise. Ensure that your franchise provides exceptional customer service, offers high-quality products or services, and creates a positive and memorable experience for customers.

Conclusion

Starting a low-cost franchise can be an exciting and rewarding journey. By understanding the benefits of low-cost franchises, identifying affordable opportunities, and following the steps to start your business, you can turn your entrepreneurial dreams into a reality. Remember to assess your financial situation, choose the right franchise, develop a business plan, secure financing, complete the application process, and attend training. With the right mindset and investment tips, you can build a successful and profitable franchise business.

FAQs

What are some examples of low-cost franchises?

- Examples of low-cost franchises include Cruise Planners, Jazzercise, and Stratus Building Solutions. These franchises typically have startup costs ranging from a few thousand dollars to around $50,000.

How can I finance a low-cost franchise?

- You can finance a low-cost franchise through traditional bank loans, SBA loans, or by seeking funding from friends and family. It’s important to compare different financing options and choose the one that best suits your needs.

What should I look for in a low-cost franchise?

- When evaluating low-cost franchises, look for a proven track record of success, a strong support system for franchisees, and a business model that aligns with your interests and skills.

How long does it take to start a low-cost franchise?

- The timeline for starting a low-cost franchise can vary depending on the franchise and the application process. Generally, it can take anywhere from a few months to a year to complete the application, attend training, and open your business.

What are the risks associated with low-cost franchises?

- Like any business venture, low-cost franchises come with risks. These can include market fluctuations, competition, and the potential for financial loss. However, thorough research and a well-crafted business plan can help mitigate these risks.

0 Response to "How to Start a Franchise Business with Low Investment"

Post a Comment