How to Manage Cash Flow in Small Businesses: Expert Tips

Imagine you're steering a ship through stormy seas. You need to navigate carefully, anticipate challenges, and ensure your vessel is in top condition. Managing cash flow in small businesses is much the same. It's about more than just staying afloat; it's about plotting a course for growth and success. So, let's dive in and explore how you can master the art of cash flow management.

Understanding Cash Flow: The Lifeblood of Your Business

Cash flow is the heartbeat of your business, the ebb and flow of money that keeps your enterprise alive. It's not just about profits; it's about the timing of income and expenses. Even a profitable business can face cash flow problems. So, how do you keep your business's heart beating strong?

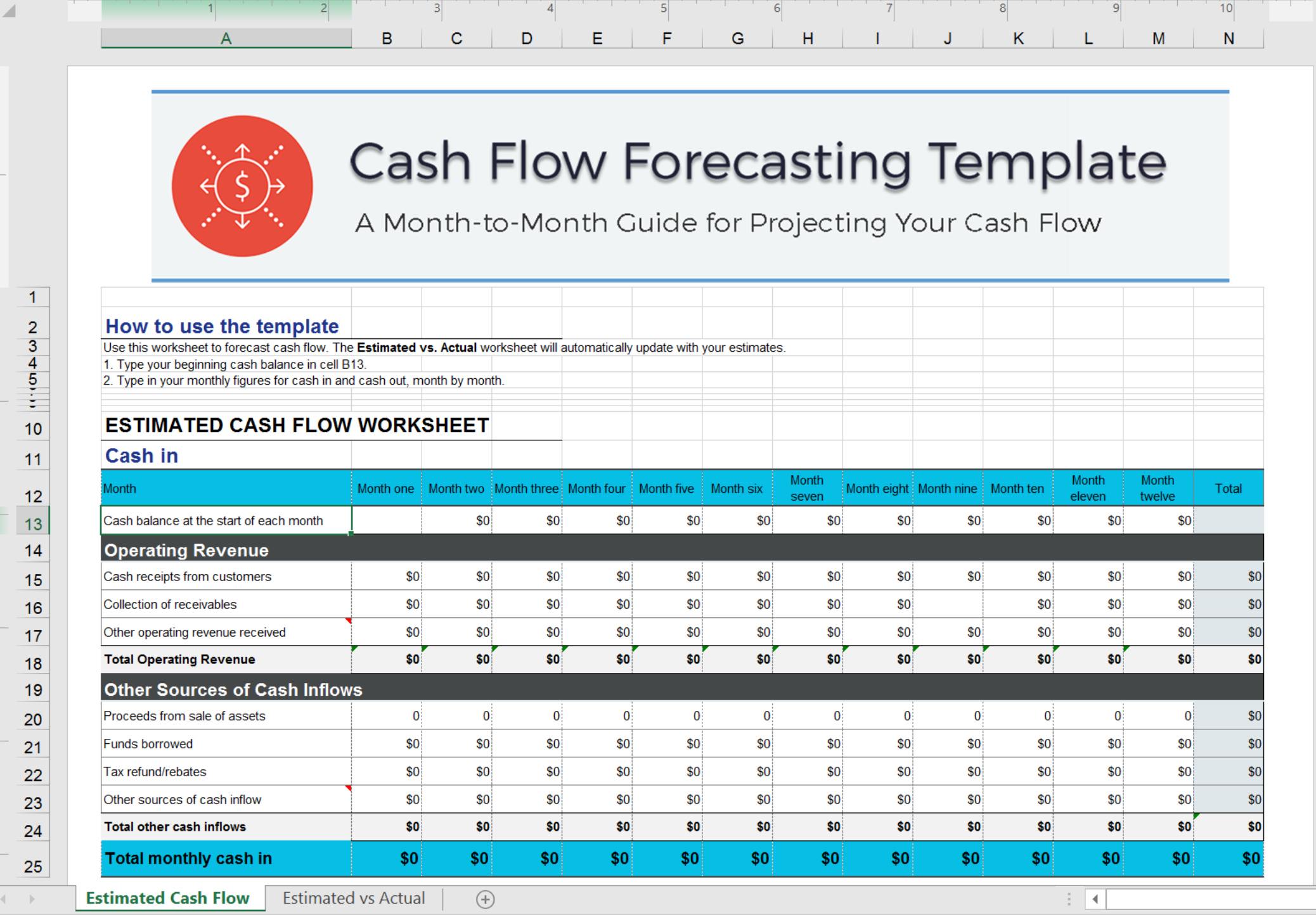

Cash Flow Forecasting: Your Roadmap to Success

Just as a ship's captain uses charts to plan their journey, cash flow forecasting is your roadmap to financial success. It's about predicting your income and expenses over a set period. But how do you create an accurate forecast?

Start by looking at your historical data. What are your regular expenses? When do your biggest sales occur? Tools like QuickBooks or Xero can help you track and analyze this data. Remember, the more detailed your forecast, the better prepared you'll be.

Small Business Accounting: The Compass Guiding Your Journey

Accurate small business accounting is like a compass, keeping you on course and alerting you when you veer off track. It's not just about tracking money in and out; it's about understanding where you're making money and where you're spending it.

" width="250" height="250">

" width="250" height="250">Invest in good accounting software. Tools like FreshBooks or Zoho Books can automate tasks, reduce errors, and give you real-time insights. Regularly review your books, or better yet, work with a professional bookkeeper or accountant. They can provide valuable insights and help you avoid costly mistakes.

Financial Planning: Charting Your Course

Financial planning is about setting your destination and charting your course. It's about deciding where you want your business to be in one, five, or ten years, and figuring out how to get there.

Start by setting clear financial goals. Are you aiming to increase revenue, expand your team, or open a new location? Next, create a budget that supports these goals. This is where budget management comes into play. Be realistic about your income and expenses, and regularly review and adjust your budget as needed.

Revenue Optimization: Maximizing Your Income

Revenue optimization is about squeezing every drop of profit from your business. It's about understanding your customers, your market, and your products, and using this knowledge to maximize your income.

Start by analyzing your sales data. What are your best-selling products or services? Who are your most valuable customers? Tools like Google Analytics can help you understand this data and use it to drive growth.

Next, look for opportunities to increase revenue. Can you raise your prices, upsell to existing customers, or expand your product range? Remember, every dollar counts.

Expert Tips for Managing Cash Flow

Now that we've covered the basics, let's dive into some expert tips for managing cash flow:

1. Invoice Promptly and Chase Payments

Don't wait to invoice your customers. The sooner you invoice, the sooner you get paid. Also, don't be afraid to chase late payments. You've earned that money, so don't be shy about asking for it.

2. Negotiate Better Terms

Negotiate better terms with your suppliers. Can you get a discount for early payment? Can you extend your payment terms? Every little bit helps.

3. Build an Emergency Fund

Unexpected expenses happen. Build an emergency fund to cover these costs and protect your business from cash flow crises.

4. Invest in Growth

Don't be afraid to invest in growth opportunities. Sometimes, you have to spend money to make money. Just make sure these investments are part of your financial plan.

5. Regularly Review and Update Your Cash Flow Forecast

Your cash flow forecast isn't a set-it-and-forget-it document. Regularly review and update it to reflect the reality of your business.

Conclusion: Navigating Your Business to Success

Managing cash flow in small businesses is a journey, not a destination. It's about understanding your business, planning for the future, and adapting to change. It's about navigating your business through calm seas and stormy weather, steering it towards success.

So, are you ready to take the helm and guide your business to success? Remember, you're not alone. There are countless tools, resources, and professionals out there to help you on your journey. So, let's set sail and navigate our businesses to success.

FAQs

Q: What is the difference between cash flow and profit? A: Profit is the amount of money your business earns after expenses. Cash flow is the movement of money in and out of your business. A business can be profitable but still have cash flow problems.

Q: How often should I update my cash flow forecast? A: You should update your cash flow forecast regularly, at least once a month. However, if your business is going through a period of change or uncertainty, you might want to update it more frequently.

Q: What should I do if I'm facing a cash flow crisis? A: If you're facing a cash flow crisis, stay calm and act quickly. Look for ways to increase income, such as chasing late payments or selling excess stock. Also, look for ways to reduce expenses, such as negotiating better terms with suppliers.

Q: Should I use accounting software for my small business? A: Yes, accounting software can automate tasks, reduce errors, and provide real-time insights into your business's financial health. There are many affordable and user-friendly options available for small businesses.

Q: When should I consider hiring a professional accountant or bookkeeper? A: If you're struggling to manage your business's finances, it's time to consider hiring a professional. An accountant or bookkeeper can provide valuable insights, help you avoid costly mistakes, and free up your time to focus on other aspects of your business.

0 Response to "How to Manage Cash Flow in Small Businesses: Expert Tips"

Post a Comment